Revenue Sources 101

Money in, Money Out

Welcome back gang!

For our first post on the US budget, let’s start with a high-level picture of revenue and spending and then jump into fiscal revenue a little deeper.

In 2022 the CBO is projecting:

Revenue: $4,836,000,000,000 ($4.8 Trillion)

Spending: $5,872,000,000,000 ($5.8 Trillion)

Deficit: $1,036,000,000,000 ($1 Trillion)

Currently this year, the government is projected to run a $1 trillion dollar deficit. A quick note on deficits:

If the government brings in more money via taxes, than it spends, we call that a surplus. If the government spends more than it makes via taxes, we call that a deficit. When the government runs a deficit, it needs to go out and borrow money from savers. We don’t know exactly how much money the government can borrow before people will stop lending to us, but it’s very clear that our government has earned the right to borrow a lot. Essentially the government spends what it wants to and can tax whatever it wants to. It just needs to pass congress and politically, that can be the holdup. Let’s take a look at where the government is currently getting tax revenue.

Fiscal revenues:

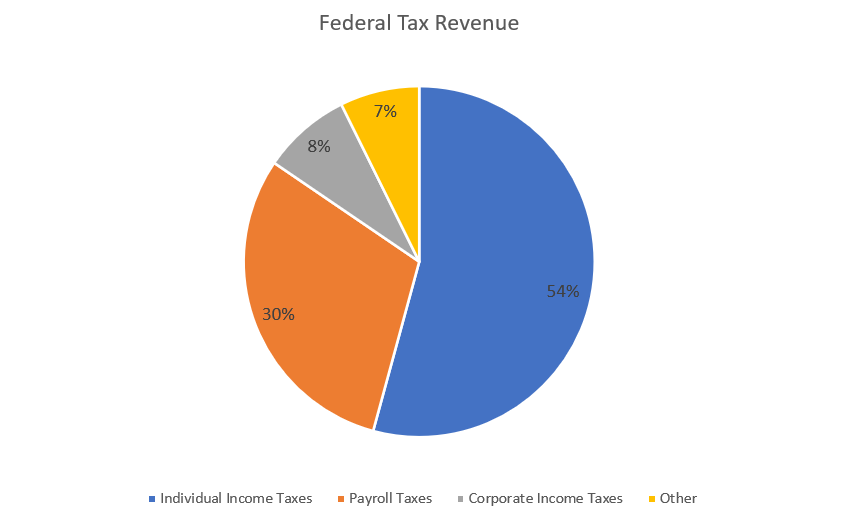

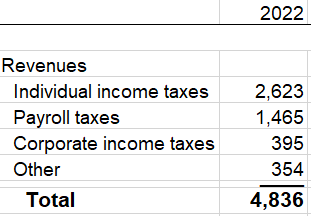

There will be roughly $4.836 trillion of revenue in 2022. It’s hard to predict this because most taxes are not flat but based on a percentage of income. Of that $4.836 trillion: (Don’t let this intimidate you! Keep reading!)

If you’re running for office, give me a call and we can dive into the details. If you’re just looking to be an informed citizen, think of the revenues coming from 4 areas:

84% of all federal revenue comes from individual income taxes, and payroll taxes. When you hear politicians talk about raising taxes to offset spending, there’s really only two areas you need to pay attention to. What are they doing with the payroll tax, and income taxes. Those are the needle moving taxes. Do corporate income taxes matter? Of course! But if the discussion is on slight adjustments in rates, then the only taxes that really matter are income and payroll taxes.

$395 billion here, $395 billion there all of a sudden, we’re talking about real money!

Theoretically, we could eliminate corporate income taxes all together and raise income taxes to offset the lost corporate taxes. It is unlikely we could eliminate income or payroll taxes and make up that revenue. Could we double corporate income taxes? That’s a more complicated question, but the answer is probably.

Politically, no politician deserves a gold star for lowering taxes, that’s like getting your kids to eat dessert. Raising taxes are getting the brussels sprouts from plate to mouth, that’s the parent that deserves a gold star. Before you on the right hit unsubscribe, just know I have the same sentiment when it comes to federal spending. Spending more is easy, cutting spending is impressive.

Because 84% of the revenue is made up of just two sections, individual income taxes and payroll taxes, I’m going to skip covering all other revenue. If you can wrap your head around just two sections of income sources, you largely understand our current federal tax system.

Congrats on making it this far! I’m working on delivering bite sized pieces that will make you an expert on your country’s finances. Next week I’ll cover individual incomes taxes and payroll taxes in a little more depth, and then we’ll move onto the spending side.

Hey Gang!

If you know anyone who would enjoy this series, please share the post with them. All of my old posts are available on my substack and I will put a glossary of the entire series below.

Have any comments you’d like to share? Did I make any statements that you are dying to correct? Subscribe to my page and reply to the next email and I’ll see it.

Table of contents:

Revenue Sources 101