Must read for any entrepreneur or investor. John H. Patterson is the man most responsible for building NCR, national cash register company. If you go to Target or any large retailer there is a good chance you find an NCR logo on the cash register.

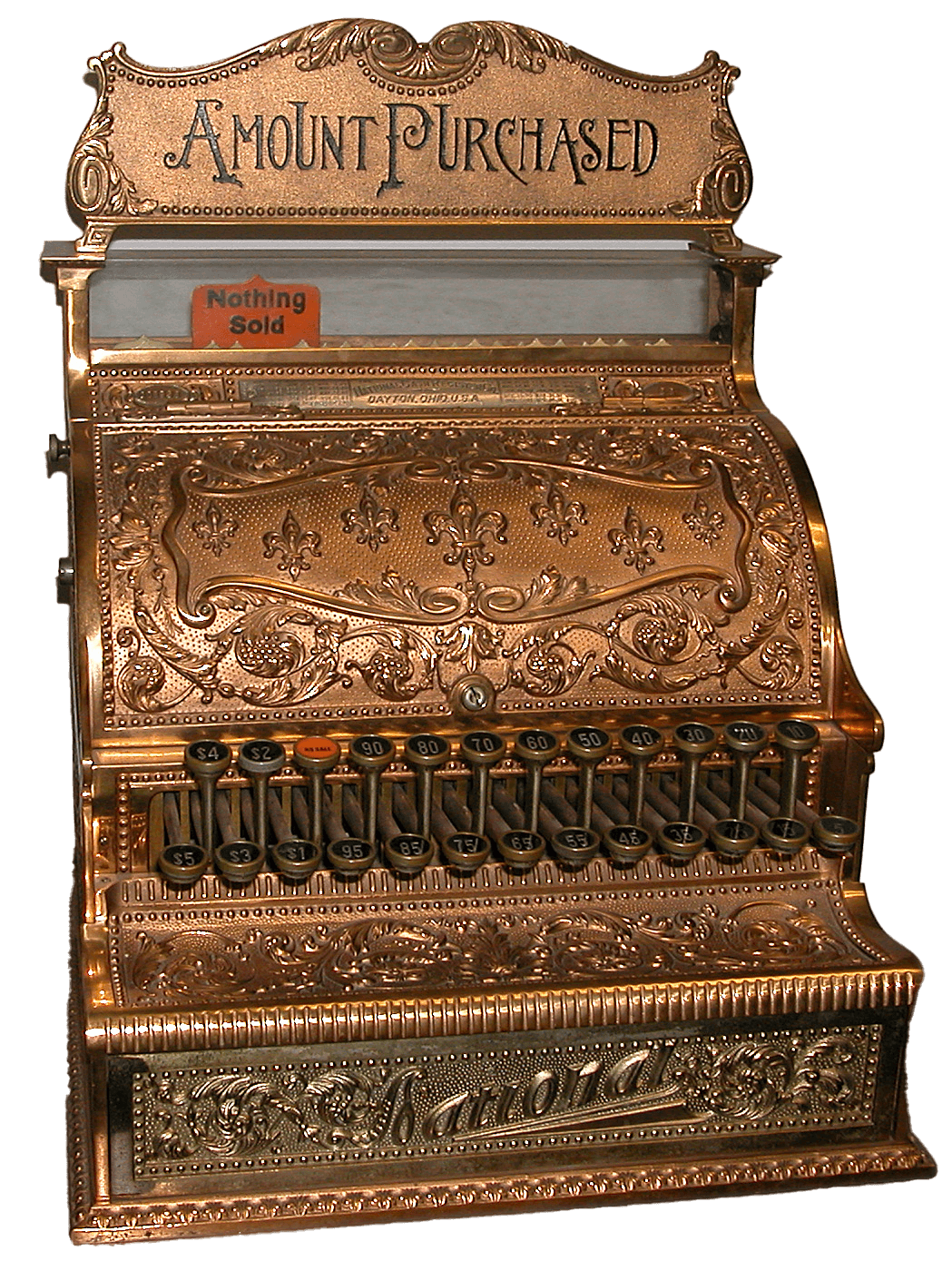

Take a look at the cash registers they would sell. You can’t tell me Steve Jobs brought beauty to technology. Jobs just correctly brought it back and did a great job doing it. But even in 1884 Patterson was well aware the beauty of a product matters.

Patterson treated NCR as a religious endeavor. And for investors, we should never underestimate the power of a smart hardworking person acting that way. Clerk theft was a real issue back then. The registers of the day were essentially adding machines. The clerk would add up the cost of your order, give you your change, and take a $1 for themselves. At the end of the day the business owner could run inventory and determine how much was stolen, but how and by whom was unclear. Was a product stolen? Was incorrect change given?

NCR added a receipt to the cash register. This way both the store and the customer collected a receipt of the transaction. The customer couldn’t steal and then demand refund, because they didn’t have a receipt. The clerk was then responsible for correct change because the owner knew exactly what they rung up, what they collected, and what change they were supposed to deliver. If they wanted to lie, they basically had to have the customer in on the scam because otherwise the customers receipt wouldn’t be correct. Employee theft is still an issue today, but the cash register receipt system might be the biggest step ever taken in mitigating that loss. Think of the massive amount of money saved in the economy by this fix.

John H. Patterson also took sales extremely seriously. To this day corporate America runs sales forces the way Patterson started. He created manuals for reps to memorize, he would quiz them on answers to common questions, he taught them how to present, where to sit the audience “make sure the light from the window strikes your face and the cash register”. The reps had defined territories and made sales in those territories. Rarely would he expand a territory because he didn’t want reps focusing on the low hanging fruit in each territory, “saturated market” sounded like an excuse to him. To this day I think when people say "saturated market” there’s a solid chance they are just making an excuse.

I learned so much from John H. Patterson. ESG folks should study him too, he was a great example of how a capitalist gives back to the community. He invested in the economy of Dayton Ohio by providing essentially boys clubs and schools. He also built massive parks around his factory and predicted that Dayton would one day flood, and when it did, he was prepared to house and feed nearly every citizen. That’s giving back. And when asked why, he would say “because it pays”. He thought the goodwill was good for business, and some degree of goodwill clearly is good for business. He thought helping the economy meant more commerce and more commerce meant more cash registers. He’s right. Companys should do particular types of giving back because, “It pays”.